Multiple Choice

Table 11.4

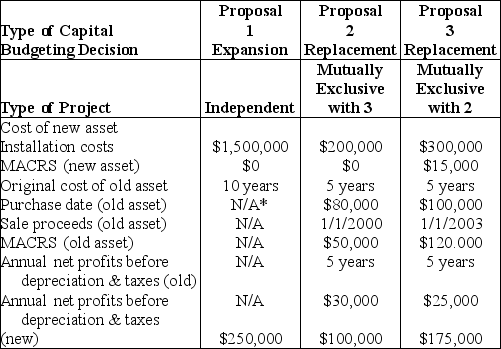

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2004. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

*Not applicable

*Not applicable

-For Proposal 3, the book value of the existing asset is ________. (See Table 11.4)

A) $21,000

B) $43,000

C) $52,000

D) $80,000

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Table 11.4<br>Computer Disk Duplicators, Inc. has been

Q15: Table 11.12<br>Yong Importers, an Asian import company,

Q16: Table 11.7<br>A corporation is assessing the risk

Q19: Table 11.11<br>Nico Manufacturing is considering investment in

Q21: Table 11.6<br>Degnan Dance Company, Inc., a manufacturer

Q34: One basic technique used to evaluate after-tax

Q37: A market risk-return function is a graphical

Q65: The tax treatment regarding the sale of

Q98: The basic variables that must be considered

Q107: Please explain the difference between a sunk