Essay

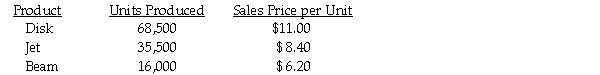

Rogers Company manufactures three products from a joint process. The Disk and the Jet can be sold at split-off, but the Beam must be processed further at a total cost of $36,000. Total joint costs for the year amounted to $1,740,000. Additional data are as follows:  Required: Using the relative-sales-value method of allocating joint costs, determine the joint costs allocated to each product.

Required: Using the relative-sales-value method of allocating joint costs, determine the joint costs allocated to each product.

Correct Answer:

Verified

Disk:

68,500 × $11.00 = $753,500

Jet:

35...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

68,500 × $11.00 = $753,500

Jet:

35...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Activity-based accounting systems<br>A) accumulate overhead costs by

Q45: The necessary cost of an activity that

Q46: The company cafeteria is an example of

Q47: John Gordan Company had the following activities,

Q48: Activity-based costing is also known as<br>A) transaction-based

Q50: Upjohn Company manufactures four products from a

Q51: City Company has two service departments, Maintenance

Q52: Which of the following is NOT likely

Q53: John Gordan Company had the following activities,

Q54: One conventional way of allocating joint costs