Multiple Choice

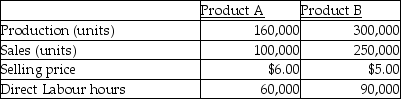

The following information refers to the Cowan Company's past year of operations.

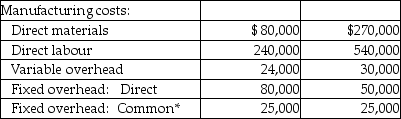

*Common overhead totals $50,000 and is divided equally between the two products.

*Common overhead totals $50,000 and is divided equally between the two products.

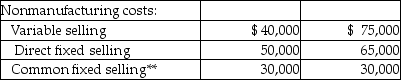

**Common fixed selling totals $60,000 and is divided equally between the two products.

Budgeted fixed overhead for the year of $180,000 equalled actual fixed overhead. Fixed overhead is assigned to products using a plant-wide rate based on expected direct labour hours, which were 150,000. The company had 5,000 of Product B in inventory at the beginning of the year. These units had the same unit cost as the units produced during the year.

-The unit product cost for Product A using absorption costing is

A) $2.15.

B) $2.45.

C) $2.60.

D) $2.80.

Correct Answer:

Verified

Correct Answer:

Verified

Q51: The only difference between variable and absorption

Q52: All costs other than direct material and

Q53: The three major categories of manufacturing costs

Q54: All costs other than direct material or

Q55: Schultz Company reported the following information about

Q57: The Majors Company has gathered the following

Q58: A sacrifice or giving up of resources

Q59: A company has the following information:<br> <img

Q60: Which of the following is NOT a

Q61: Elder, Inc. has supplied the following information: