Essay

Bowzer Industries began operations on January 1, 2006. The company sells a single product for $10 per unit. During 2006, 60,000 units were produced and 50,000 units were sold. There was no work in process inventory at December 31, 2006.

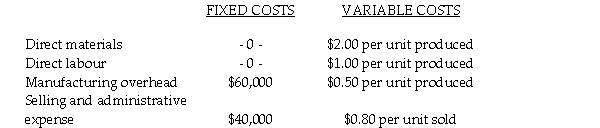

Bowzer uses an actual cost system for product costing and actual costs for 1998 were as follows:  a. What is the product cost per unit under:

a. What is the product cost per unit under:

(i) variable costing

(ii) absorption costing

b. What is the finished goods inventory cost at December 31, 2006 under:

(i) variable costing

(ii) absorption costing

c. Prepare income statements for 2006 under:

(i) variable costing

(ii) absorption costing

d. Reconcile the difference between variable costing income and absorption costing income.

Correct Answer:

Verified

a. Cost per unit using variable costing:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: Which of the following is NOT considered

Q69: Sales revenue less cost of goods sold.

Q70: Costs that can be identified specifically and

Q71: The following information was taken from the

Q72: A company has the following information:<br> <img

Q74: Prime costs include<br>A) direct labour and factory

Q75: Expenses that are not directly traceable to

Q76: The term expense is used to describe

Q77: The Minler Company began the year 2006

Q78: In the contribution approach, all factory overhead