Essay

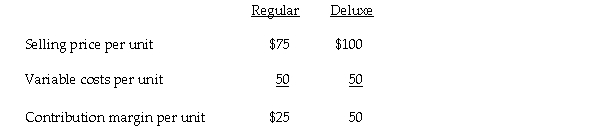

The Orton Company produces two types of food processors. Information about the two products for 2006 is as follows:  The company expects fixed costs to be $150,000 in 2006. The firm expects 80% of its sales (in units) to be Regular model food processors.

The company expects fixed costs to be $150,000 in 2006. The firm expects 80% of its sales (in units) to be Regular model food processors.

a. Determine the break-even point in units.

b. Determine sales in units of Regular and Deluxe models necessary to generate a before-tax profit of $90,000.

c. Determine sales in units of Regular and Deluxe models necessary to generate an after-tax profit of $90,000 if the tax rate is 40 percent.

Correct Answer:

Verified

b. Sales in units n...

b. Sales in units n...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: A firm's ratio of fixed and variable

Q44: Contribution margin<br>A) is not the same as

Q45: Assume the following cost information for Quayle

Q46: Reese, Inc. produces pliers. Each pair of

Q47: The volume of sales at which revenue

Q50: Wallace, Inc. produces squirt guns and has

Q51: If the sales price per unit is

Q52: The Isbit Company has developed the following

Q53: A variable cost varies per unit.

Q54: The way in which the activities of