Essay

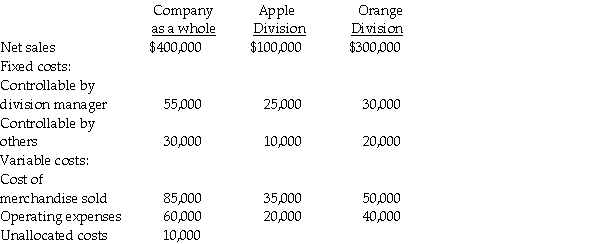

The following information is available for Hupp Corporation and its two divisions, Apple and Orange:  Required:

Required:

a. Compute the contribution margin for the Apple Division.

b. Compute the contribution controllable by the manager of the Orange Division.

c. Compute the contribution by segment for the Apple Division.

d. Compute the income before income taxes for Hupp Corporation.

Correct Answer:

Verified

a. $100,000 - ($35,000 + 20,000) = $45,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: To create a management control system that

Q70: Quality control is a concern of<br>A) privately

Q72: Uncontrollable costs<br>A) are influenced by a manager's

Q73: Nagel Corporation and Connors Company are computer

Q75: The effort to insure that products and

Q76: Profit centres<br>A) have responsibility for controlling costs

Q77: A responsibility centre whose success is measured

Q78: An investment centre's success is measured only

Q79: A report that displays the financial impact

Q99: Define a management control system and identify