Multiple Choice

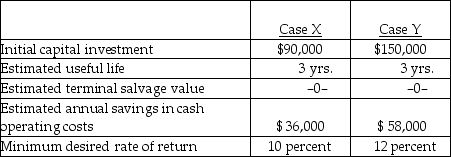

Below are two potential investment alternatives:

-There are two key aspects of capital budgeting: (1) investing decisions and (2)

A) accounting decisions.

B) financing decisions.

C) discount decisions.

D) payback decisions.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: The decline in the general purchasing power

Q56: Below are two potential investment alternatives:<br> <img

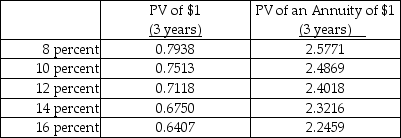

Q57: Use the following information to answer the

Q58: Below are two potential investment alternatives:<br> <img

Q59: Projects that, if accepted or rejected, will

Q60: A company with pretax income of $60,000

Q62: Alpha Company has the following information:<br> <img

Q63: Discounting<br>A) is the process of determining value

Q65: Beta Company has the following information:<br> <img

Q66: The rate of return used to compute