Multiple Choice

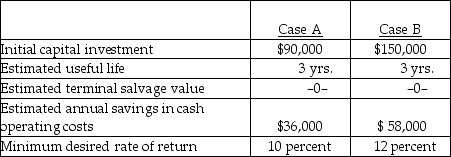

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

-In capital budgeting, the relevant tax rate to consider is the

A) prior year tax rate.

B) average rate expected for the company.

C) marginal rate expected for the company.

D) highest rate that applies to U.S. corporations.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: A rate that is calculated as income

Q22: The factor used to convert future cash

Q23: If the appropriate tax rate is 35%,

Q24: Use the following information regarding a production

Q25: A tax rule that assumes a newly

Q27: If a company pays taxes of 15

Q28: Use the following information to answer the

Q29: Use the following information to answer the

Q30: The process of altering certain key variables

Q52: The cash outflow for the purchase of