Multiple Choice

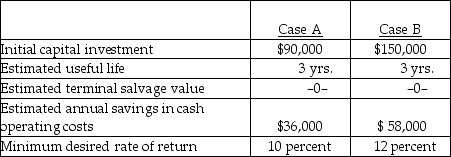

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

-The marginal tax rate is

A) the average rate for the company.

B) the highest possible rate the company might be expected to pay.

C) the lowest tax rate applicable to the company.

D) the rate paid on additional amounts of pretax income.

Correct Answer:

Verified

Correct Answer:

Verified

Q92: The annual income statement of ZAP Inc.

Q93: The time required for a project to

Q94: Alpha Company has the following information:<br> <img

Q96: Below are two potential investment alternatives:<br> <img

Q98: Use the following information regarding a production

Q99: Projects that, if accepted, preclude the acceptance

Q100: Which of the following is NOT usually

Q101: Allowable depreciation under the income tax act

Q102: Future cash flows expressed in present value

Q105: Which of the following methods determines the