Multiple Choice

Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

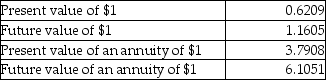

Time value factors are given below for 5 years and an interest rate of 10 percent.

-What is the present value of the after-tax cash flows from operations, exclusive of depreciation?

A) $85,293

B) $13,971

C) $ 9,778

D) $59,705

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The tax rate paid on additional amounts

Q15: The differential approach is limited to cases

Q16: The cost of assets is recognized by

Q17: Use the following information regarding a production

Q18: Which of the following statements about the

Q21: A rate that is calculated as income

Q22: The factor used to convert future cash

Q23: If the appropriate tax rate is 35%,

Q24: Use the following information regarding a production

Q25: A tax rule that assumes a newly