Essay

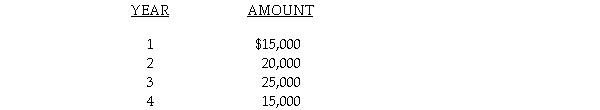

A capital investment project requires an investment of $50,000 and has an expected life of four years. Annual cash flows at the end of each year are expected to be as follows:  a. Compute the payback period assuming that the cash flows occur evenly throughout the year.

a. Compute the payback period assuming that the cash flows occur evenly throughout the year.

b. Determine the accounting rate of return for the project based on the initial investment.

c. Compute the net present value of the project using a 10% discount rate. (Round amounts to dollars.)

Correct Answer:

Verified

Correct Answer:

Verified

Q83: The present value of $10,000 to be

Q84: Which of the following statements about depreciation

Q85: Below are two potential investment alternatives:<br> <img

Q86: Below are two potential investment alternatives:<br> <img

Q87: The difference between the present value of

Q89: Which of the following statements about depreciation

Q90: Another term for market interest rate is<br>A)

Q91: Alpha Company has the following information:<br> <img

Q92: The annual income statement of ZAP Inc.

Q93: The time required for a project to