Essay

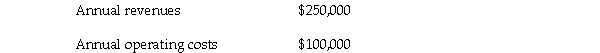

Lawton Co. is evaluating a project that requires an investment of $400,000. The company plans to dispose of the property at the end of the fourth year for $121,620. Information about cash flows associated with the project is as follows:  All cash flows occur at the end of the year. The required rate of return is 12% and the tax rate is 40%. The CCA rate is 30%.

All cash flows occur at the end of the year. The required rate of return is 12% and the tax rate is 40%. The CCA rate is 30%.

Determine the net present value of the project. (Round amounts to dollars.)

Correct Answer:

Verified

Calculation of Tax savings fro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Alpha Company has the following information:<br> <img

Q4: Use the following information to answer the

Q5: Below are two potential investment alternatives:<br> <img

Q6: When making capital-budgeting decisions, the effects of

Q7: The present value of 5-year annuity of

Q9: A company with pretax income of $45,000

Q10: The cash inflow effect of a disposal

Q12: Below are two potential investment alternatives:<br> <img

Q13: Below are two potential investment alternatives:<br> <img

Q35: Quoted market interest rate that includes an