Multiple Choice

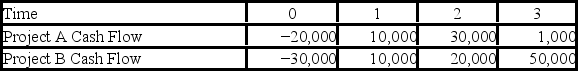

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

A) Accept both A and B

B) Accept neither A nor B

C) Accept A, reject B

D) Reject A, accept B

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Compute the IRR for Project X and

Q63: Suppose your firm is considering investing in

Q64: Compute the payback statistic for Project X

Q65: Compute the NPV statistic for Project Y

Q68: Compute the PI statistic for Project Q

Q69: Compute the NPV for Project X and

Q70: Suppose your firm is considering investing in

Q71: Suppose your firm is considering two mutually

Q75: The benchmark for the profitability index (PI)

Q116: Which rate-based decision statistic measures the excess