Multiple Choice

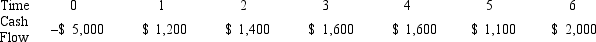

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

A) Discounted payback = 4.25 years; accept the project

B) Discounted payback = 3.50 years; accept the project

C) Discounted payback > 5 years; reject the project

D) Discounted payback = 4.67 years; reject the project

Correct Answer:

Verified

Correct Answer:

Verified

Q22: A company is considering two mutually exclusive

Q33: A capital budgeting method that converts a

Q39: Suppose your firm is considering investing in

Q43: Suppose your firm is considering two mutually

Q45: Suppose your firm is considering investing in

Q46: The net present value decision technique uses

Q59: Which of the following best describes the

Q82: A disadvantage of the payback statistic is

Q87: A graph of a project's _ is

Q107: A project costs $91,000 today and is