Multiple Choice

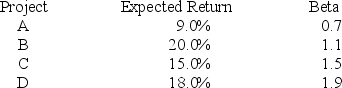

An all-equity firm is considering the projects shown as follows.  The T-bill rate is 4 percent and the market risk premium is 8 percent.If the firm uses its current WACC of 13 percent to evaluate these projects,which project(s) will be incorrectly accepted?

The T-bill rate is 4 percent and the market risk premium is 8 percent.If the firm uses its current WACC of 13 percent to evaluate these projects,which project(s) will be incorrectly accepted?

A) Project A

B) Project C

C) Project D

D) Projects C and D

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Suppose that Glamour Nails, Inc.'s capital structure

Q49: Carrie D's has 6 million shares of

Q74: Paper Exchange has 80 million shares of

Q78: TJ Co. stock has a beta of

Q108: Crab Cakes Ltd. has 5 million shares

Q114: JLP Industries has 6.5 million shares of

Q117: An average of which of the following

Q119: Which of the following statements is correct?<br>A)

Q123: KatyDid Clothes has a $150 million ($1,000

Q124: Which of the following statements is correct?<br>A)