Multiple Choice

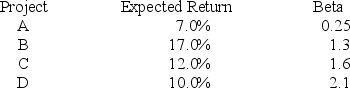

An all-equity firm is considering the projects shown as follows.  The T-bill rate is 4 percent and the market risk premium is 9 percent.If the firm uses its current WACC of 14 percent to evaluate these projects,which project(s) will be incorrectly rejected?

The T-bill rate is 4 percent and the market risk premium is 9 percent.If the firm uses its current WACC of 14 percent to evaluate these projects,which project(s) will be incorrectly rejected?

A) Project A

B) Project B

C) Project C

D) Project D

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Any debt and preferred stock components of

Q8: What is the theoretical minimum for the

Q9: Which of the following is a situation

Q11: Which of the following will increase the

Q57: Apple's 9 percent annual coupon bond has

Q73: JackITs has 5 million shares of common

Q76: Which of the following is a true

Q79: Suppose that PAW, Inc. has a capital

Q107: PNB Industries has 20 million shares of

Q122: JaiLai Cos. stock has a beta of