Multiple Choice

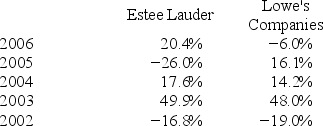

Consider the following annual returns of Estee Lauder and Lowe's Companies:  Compute each stock's average return,standard deviation,and coefficient of variation.

Compute each stock's average return,standard deviation,and coefficient of variation.

A) Estee Lauder: 9.02 percent; 17.99 percent; 2.00 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

B) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

C) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 25.46 percent; 2.39

D) Estee Lauder: 10.7 percent; 17.79 percent; 1.66 and Lowe's Companies: 12.64 percent; 18.99 percent; 1.50

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Which of the following is correct?<br>A) Over

Q23: Year-to-date, Oracle had earned a 15.0 percent

Q24: Consider the characteristics of the following three

Q26: Consider the following correlations: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1326/.jpg" alt="Consider

Q28: Noble stock was $60.00 per share at

Q29: Which of the following are investor diversification

Q31: Which of these is the portion of

Q33: Which of the following is defined as

Q52: The past three monthly returns for Kohl's

Q82: The optimal portfolio for you will be<br>A)