Financial Statements for Narumi Company Appear Below -Narumi Company's Times Interest Earned for Year 2 Was Closest

Multiple Choice

Financial statements for Narumi Company appear below:

-Narumi Company's times interest earned for Year 2 was closest to which of the following?

A) 4.6 times.

B) 6.6 times.

C) 7.6 times.

D) 12.4 times.

Correct Answer:

Verified

Correct Answer:

Verified

Q169: Financial statements for Laroche Company appear

Q170: If a loss resulting from an earthquakeis

Q171: Financial statements for Marcial Company appear

Q172: Financial statements for Marcell Company

Q173: Financial statements for Marcial Company appear

Q175: Financial statements for Marcial Company appear

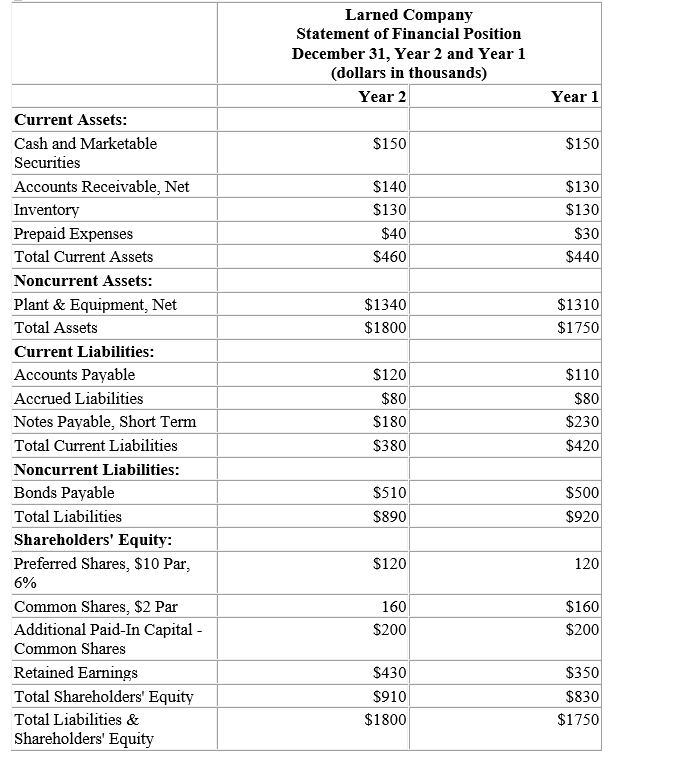

Q176: Financial statements for Larned Company

Q177: Arlberg Company's net income last year was

Q178: <span class="ql-formula" data-value="\begin{array}{l}\text { Selected data for

Q179: Financial statements for Larosa Company