Essay

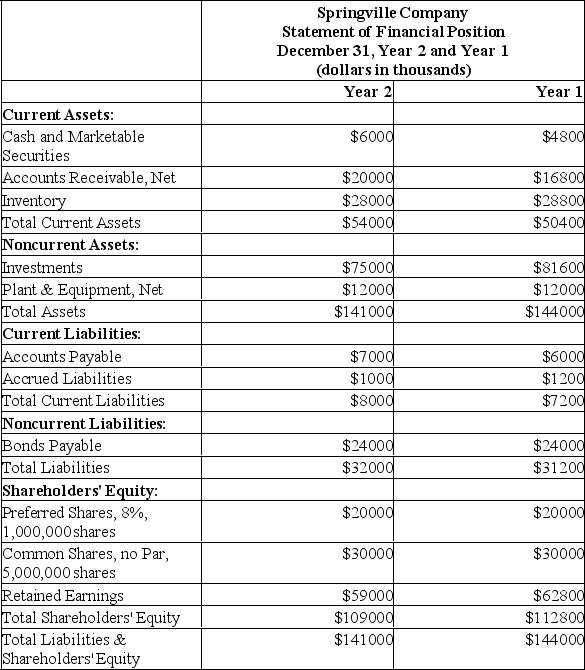

Comparative financial statements for Springville Company for the last two years appear below.The market price of Springville's common shares was $25 per share on December 31,Year 2.During Year 2,dividends of $2,000,000 were paid to preferred shareholders and $10,000,000 to common shareholders.

Required:

Calculate the following for Year 2:

a)Dividend payout ratio.

b)Dividend yield ratio.

c)Price-earnings ratio.

d)Accounts receivable turnover.

e)Inventory turnover.

f)Return on total assets.

g)Return on common shareholders' equity.

h)Was financial leverage positive or negative for the year? Explain.

Correct Answer:

Verified

a)Dividend payout ratio = Dividends per ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Last year,Allen Company's average collectionperiod for accounts

Q7: Selected financial data for Irvington Company

Q9: To put the working capital figure into

Q10: Financial statements for Orantes Company

Q12: Selected data from Sheridan Corporation's year-end

Q13: Financial statements for Marcial Company appear

Q14: Last year,Dunn Company purchased $1,920,000of inventory.The cost

Q15: Financial statements for Orantes Company

Q16: Financial statements for Orantes Company

Q120: The inventory turnover ratio is equal to