Financial Statements for Quade Company Appear Below Total Dividends Paid During Year 2 Were $210,000,of Which $18,000

Essay

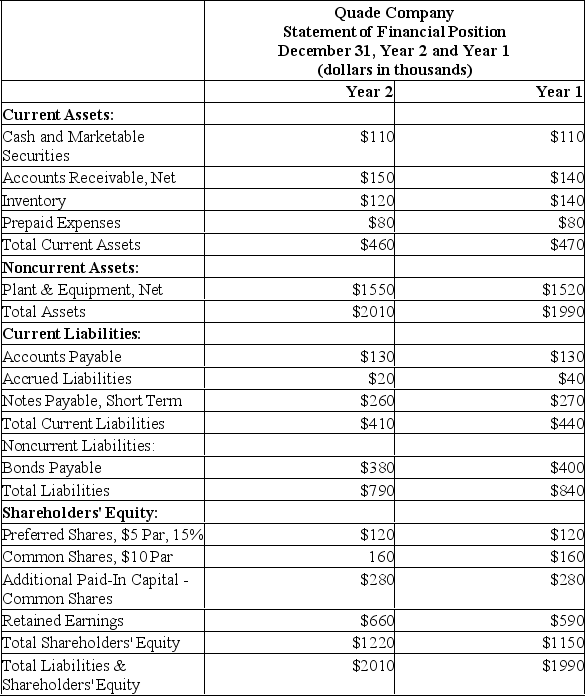

Financial statements for Quade Company appear below:

Total dividends paid during Year 2 were $210,000,of which $18,000 were preferred dividends.The market price of a common share on December 31,Year 2 was $230.

Required:

Calculate the following for Year 2:

a)Earnings per share.

b)Price-earnings ratio.

c)Dividend yield ratio.

d)Return on total assets.

e)Return on common shareholders' equity.

f)Book value per share.

Correct Answer:

Verified

a)Earnings per share = (Net Income - Pre...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Marcy Corporation's current ratio is currently 1.75

Q64: Financial statements for Narita Company

Q65: Financial statements for Orantes Company

Q66: Dratif Company's working capital is $33,000,and its

Q67: Cameron Company had 50,000 common shares

Q69: Financial statements for Marcial Company appear

Q70: Eral Company has $17,000 in cash,$3,000 in

Q71: Financial statements for Lowe Company appear

Q72: Crasler Company's net income last year was

Q73: The gross margin percentageis most likely to