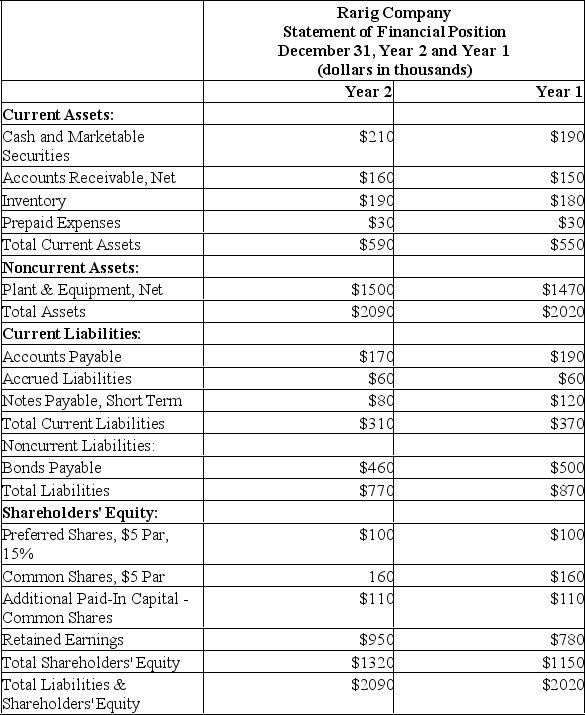

Financial Statements for Rarig Company Appear Below Required:

Calculate the Following for Year 2:

A)Current Ratio

Essay

Financial statements for Rarig Company appear below:

Required:

Calculate the following for Year 2:

a)Current ratio.

b)Acid-test (quick)ratio.

c)Average collection period (age of receivables).

d)Inventory turnover.

e)Times interest earned.

f)Debt-to-equity ratio.

Correct Answer:

Verified

a)Current ratio = Current assets/Current...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q144: <span class="ql-formula" data-value="\begin{array}{l}\text { Selected data for

Q145: Financial statements for March Company appear

Q146: Financial statements for Oratz Company

Q147: Arquandt Company's net income last year was

Q148: During the year just ended,James Company purchased

Q150: Frabine Company had $150,000 in sales on

Q151: Financial statements for Oratz Company

Q152: Erambo Company has $11,000 in cash,$6,000 in

Q153: Fulton Company's price-earnings ratio is 8.0,and the

Q154: Grapp Company had $130,000 in sales on