Toyworld Manufactures and Sells a Line of Toys Required:

A)Your Assistant Has Requested You to Complete the "Flexible

Essay

Toyworld manufactures and sells a line of toys.The toys are primarily distributed through department stores.As president of Toyworld,you wanted to analyze Toyworld's profitability.Your capable assistant provided you with the following data:

Required:

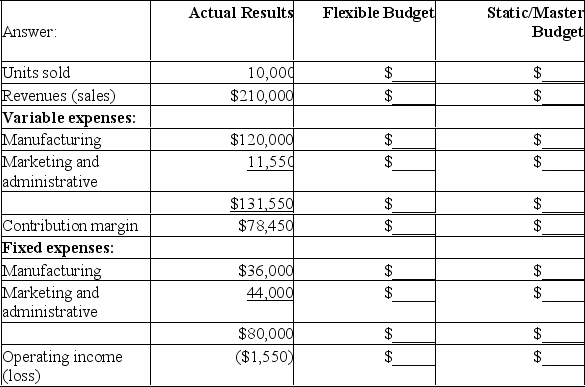

a)Your assistant has requested you to complete the "Flexible Budget" and "Static/Master Budget" columns of the analysis,reproduced below (She had to attend to an out-of-town emergency):

b)Calculate the following variances: flexible budget variance,sales volume variance,and total static budget variance.

Correct Answer:

Verified

a)

b)Calculation of Variances

b)Calculation of Variances

Flexible...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Flexible...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Barley Enterprises has budgeted unit sales

Q56: Tilson Company has projected sales and

Q58: James Enterprises has budgeted unit

Q59: Barley Enterprises has budgeted unit sales

Q60: The participative budget can be a very

Q62: The International Company makes and

Q63: The Bandeiras Company, a merchandising firm,

Q64: Fougere Realtors,Inc.,specializes in home re-sales.It earns

Q65: Superior Industries' sales budget shows quarterly

Q66: Noel Enterprises has budgeted sales in