Multiple Choice

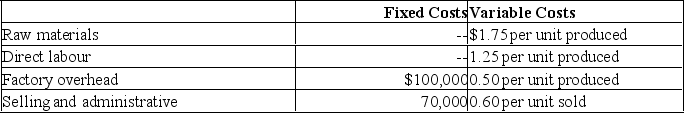

Indiana Corporation produces a single product that it sells for $9 per unit.During the first year of operations,100,000 units were produced and 90,000 units were sold.Manufacturing costs and selling and administrative expenses for the year were as follows:

What was Indiana Corporation's operating income for the year using variable costing?

A) $181,000.

B) $271,000.

C) $281,000.

D) $371,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Absorption costing treats all manufacturing costs as

Q101: Last year, Walsh Company manufactured

Q102: Fahey Company manufactures a single product

Q103: During the last year,Hansen Company had operating

Q104: Farron Company, which has only one

Q105: Lee Company,which has only one product,has

Q108: At the end of last year,Lee Company

Q109: DeAnne Company's variable costing income

Q110: Operating income determined using absorption costing can

Q111: Hatfield Company, which has only