Multiple Choice

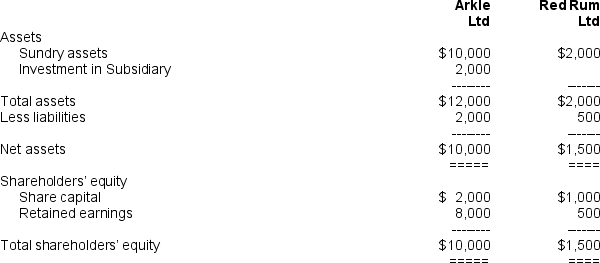

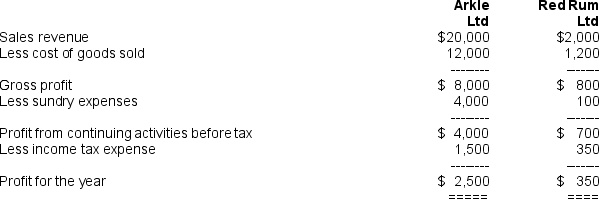

For the year ended June 30 20X6,the following financial statements were prepared for the two companies Arkle Ltd and Red Rum Ltd (amounts in thousands) .At that date,the net assets of Red Rum Ltd approximated their fair value. Balance Sheets as at June 30 20X6 Income Statements for the Year ended June 30 20X6

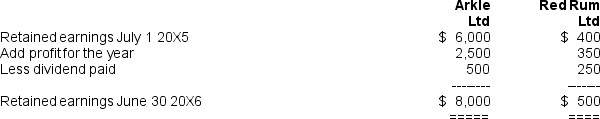

Income Statements for the Year ended June 30 20X6 Statements of Movements in Retained Earnings Year ended June 30 20X6

Statements of Movements in Retained Earnings Year ended June 30 20X6 On July 1 20X5,Arkle Ltd acquired all of the share capital for $2,250,000 cash.Immediately subsequent to acquisition,Red Rum Ltd paid a dividend of $250,000 out of retained earnings at July 1 20X5.The goodwill paid on the investment was:

On July 1 20X5,Arkle Ltd acquired all of the share capital for $2,250,000 cash.Immediately subsequent to acquisition,Red Rum Ltd paid a dividend of $250,000 out of retained earnings at July 1 20X5.The goodwill paid on the investment was:

A) $850,000

B) $750,000

C) $600,000

D) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In a business combination.share issue costs are

Q16: A dividend paid by a subsidiary out

Q19: The declaration date of a dividend determines

Q21: Under current accounting standards,a dividend declared by

Q33: A subsidiary which is identified as a

Q35: Explain the consequences of distinguishing between pre

Q37: Where a subsidiary has declared but not

Q39: Consolidation worksheet adjusting journal entries are recorded:<br>A)

Q44: Outline the regulatory basis for the requirement

Q48: The purpose of consolidated financial statements is