Multiple Choice

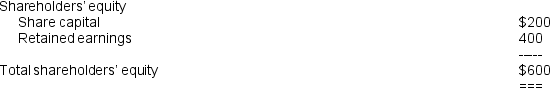

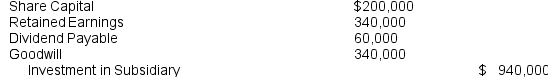

On July 1 20X5,Helios Ltd acquired all of the share capital of Havers Pty Ltd (100,000 shares) for $10 per share.During the year ended June 30 20X6,Helios Ltd received a dividend from Havers Ltd of $60,000; a dividend which had been declared by the directors of Havers Ltd in the year ended June 30 20X5 and was not subject to ratification by the shareholders of Havers Ltd.During the year ended June 30 20X6,Helios Ltd received an interim dividend of $40,000 from Havers Ltd and the directors of Havers Ltd declared a final dividend of $60,000.At June 30 20X6,The directors estimated that the fair value of the shares in Havers Ltd was only $9 per share at that date,but the estimated fall in value was considered to be only temporary and the carrying amount of the investment had not been impaired. At the date of acquisition,July 1 20X5,the shareholders' equity of Havers Ltd was (amounts in thousands) : At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

A)

B)

C)

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q15: In August 20X6,Caesar Ltd acquired the issued

Q16: Goodwill on acquisition is recorded when:<br>A) the

Q17: During August 20X5,Atticus Ltd acquired the share

Q19: It is important to distinguish between pre

Q21: Any goodwill arising on a business combination

Q22: A gain on bargain purchase will be

Q22: A parent and its subsidiary adopt different

Q25: Assume the same data as in Question

Q27: Where a subsidiary's financial reporting period ends

Q43: A company with a constitution that provides