Multiple Choice

P Ltd lends $200,000 to its subsidiary S Ltd.At the end of the year S Ltd has paid interest of $18,000 and owes a further $2,000 (assume a tax rate of 30%) The required consolidation entry is:

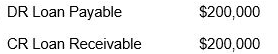

A)

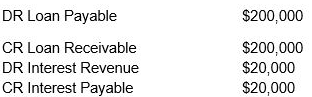

B)

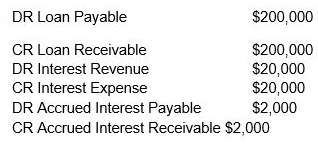

C)

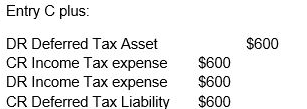

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: S Ltd acquired land from its parent

Q9: A Ltd sells inventory to its parent

Q10: Current accounting regulations require the separate disclosures

Q21: Unrealised gains on the intragroup sale of

Q28: An impairment loss will be recognised in

Q30: Using the same facts as Question 14

Q30: Deferred tax assets and liabilities arising from

Q32: Dividends paid by the parent company and

Q33: Which of the following accounts cannot be

Q37: Consolidation entries never adjust cash because intragroup