Multiple Choice

Assuming the same facts as for Question 12 but that 2 years later S sold the land outside the group for $1,200,000 the consolidation journal entry required would be (ignoring tax effects) :

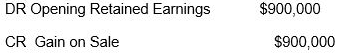

A)

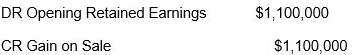

B)

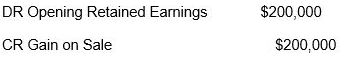

C)

D) no entry required

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: When a depreciable asset is sold at

Q8: Explain why cash will never be adjusted

Q11: A subsidiary which is 75% owned by

Q12: P Ltd provides management services to its

Q16: For non-current assets measured using the revaluation

Q18: Tax effect adjustments only apply to consolidation

Q19: Unrealised profits on the intragroup sale of

Q19: Unrealised profits on intra-group sale of inventories

Q20: Unrealised gains and losses on intra-group sales

Q26: Explain why it is necessary to adjust