Multiple Choice

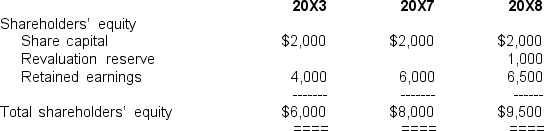

The following statements of shareholders' equity were prepared for Harnham Hill Ltd,a 20% owned associate of the parent entity Delville Wood Ltd,at June 30 (amounts in thousands) :  Other information:

Other information:

I.On July 1 20X3,Delville Wood Ltd acquired its 20% investment for a cash outlay of $2,000,000.

II.During the year ended June 30 20X8,Harnham Hill Ltd earned a profit of $1,400,000 before tax (income tax expense $400,000) and paid a dividend of $500,000.

III.Any goodwill element in the cost of the investment had not been impaired in the investment period.

In preparing the consolidated financial statements for the year ended June 30 20X8,the adjustment to recognise the equity of Delville Wood Ltd in its associate would be:

A)

B)

C) 11ecebb7_15d0_06a3_bb85_3f1d39b5bd28_TB1434_11.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q16: On November 1 20X6,a parent entity Midstream

Q17: In equity accounting the investment in

Q18: Discuss whether equity accounting profits are 'realised'

Q19: The following statements of shareholders' equity were

Q20: Goodwill arising on an equity investment is

Q21: An investment in an associate company will

Q25: Investor Ltd holds 25% of the voting

Q26: The following statements of shareholders' equity were

Q31: The equity carrying amount of an investment

Q36: A gain on bargain purchase of an