Multiple Choice

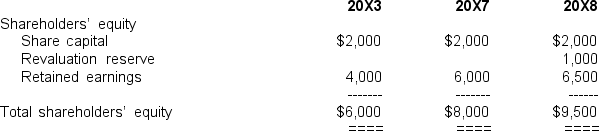

The following statements of shareholders' equity were prepared for Harnham Hill Ltd,a 20% owned associate of the parent entity Delville Wood Ltd,at June 30 (amounts in thousands) :  Other information:

Other information:

I.Delville Wood Ltd acquired its 20% investment on July 1 20X3 for a cash outlay of $2,000,000.

II.During the year ended June 30 20X8,Harnham Hill Ltd earned a profit of $1,400,000 before tax (income tax expense $400,000) and paid a dividend of $500,000.

III.At June 30 20X7,Delville Wood Ltd held inventories which had been supplied by Harnham Hill Ltd at a mark-up of $100,000.

IV.At June 30 20X8,a subsidiary of Delville Wood Ltd held inventories that had been supplied by Harnham Hill Ltd at a mark-up of $50,000.

V.During the year ended June 30 20X8,Delville Wood Ltd charged Harnham Hill Ltd with a management fee of $100,000 for administration services.

VI.In the income statement of Harnham Hill Ltd was interest revenue of $50,000 which had been earned on a loan made to a subsidiary of Delville Wood Ltd.

VII.The income tax rate was 30%.

VIII.Any goodwill element in the cost of the investment had not been impaired in the investment period.

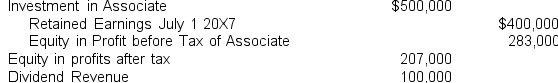

In preparing the consolidated financial statements for the year ended June 30 20X8,the journal adjustment to recognise the equity of Delville Wood Ltd in its associate would be:

A)

B)

C)

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: It is possible that different entities can

Q14: The equity accounting method must be applied

Q18: Investors that are not parent entities must

Q23: Where an associate makes profits subsequent to

Q35: Even though an investee may be an

Q37: On January 1 20X7,a parent entity Emborough

Q38: Indicia of the position that an investor

Q40: Assume the same data as in Question

Q43: Which of the following is not an

Q44: If an investment in an associate entity