Multiple Choice

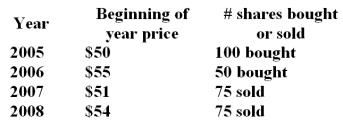

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends

-What is the geometric average return for the period?

A) 2.87%

B) 0.74%

C) 2.60%

D) 2.21%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: The dollar-weighted return is the _.<br>A) difference

Q68: You invest $1,000 in a complete portfolio.

Q69: Two assets have the following expected returns

Q70: If you require a real growth in

Q71: The geometric average of -12%,20% and 25%

Q72: What is the geometric average return over

Q74: When calculating the variance of a portfolio's

Q75: You are considering investing $1,000 in a

Q77: During the 1985 to 2008 period the

Q78: The holding period return on a stock