Multiple Choice

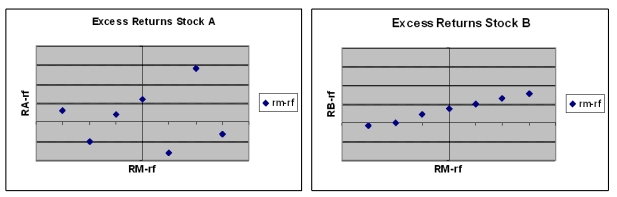

The figures below show plots of monthly excess returns for two stocks plotted against excess returns for a market index.

-Which stock is likely to further reduce risk for an investor currently holding his portfolio in a well diversified portfolio of common stock?

A) Stock A

B) Stock B

C) There is no difference between A or B

D) You cannot tell from the information given.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The term excess-return refers to _.<br>A) returns

Q16: Risk that can be eliminated through diversification

Q20: The term complete portfolio refers to a

Q21: A portfolio is composed of two

Q22: Which one of the following stock return

Q23: This stock has greater systematic risk than

Q24: An investor can design a risky portfolio

Q25: You are constructing a scatter plot of

Q27: A security's beta coefficient will be negative

Q32: Firm-specific risk is also called _ and