Multiple Choice

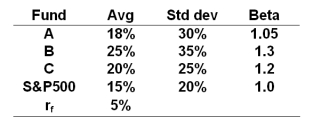

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-What is the M2 measure for portfolio B?

A) 0.43%

B) 1.25%

C) 1.77%

D) 1.43%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Chuck Douglass,an imperfect forecaster correctly predicts 57%

Q3: Consider the theory of active portfolio management.Stocks

Q4: Probably the biggest problem with evaluating portfolio

Q5: What is the term for the process

Q6: In the Treynor-Black model security analysts _.<br>A)

Q7: An attribution analysis will NOT likely contain

Q8: The average returns, standard deviations and betas

Q9: A portfolio generates an annual return of

Q10: In a particular year, Lost Hope Mutual

Q11: Portfolio managers Paul Martin and Kevin Krueger