Multiple Choice

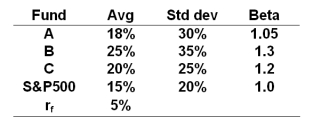

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-If these portfolios are subcomponents which make up part of a well diversified portfolio then portfolio ______ is preferred.

A) A

B) B

C) C

D) S&P500

Correct Answer:

Verified

Correct Answer:

Verified

Q43: A portfolio generates an annual return of

Q44: In a particular year, Lost Hope Mutual

Q45: What phrase might be used as a

Q46: In creating the T<sup>2</sup> measure one mixes

Q47: The table presents the actual return of

Q49: The _ calculates the reward to risk

Q50: The M<sup>2</sup> measure of portfolio performance was

Q51: In the Treynor-Black model,the weight of each

Q52: The risk free rate, average returns, standard

Q53: Empirical tests to date show _.<br>A) that