Multiple Choice

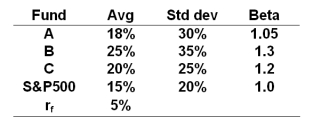

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-Based on the M2 measure,portfolio C has a superior return of _____ as compared to the S&P500.

A) -1.33%

B) 1.43%

C) 2.00%

D) 0.00%

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Active portfolio managers try to construct a

Q63: The theory of efficient frontiers has _.<br>A)

Q64: A mutual fund with a beta of

Q65: The comparison universe is _.<br>A) the bogey

Q66: _ portfolio manager(s)experience streaks of abnormal returns

Q67: Consider the theory of active portfolio management.Stocks

Q69: Most professionally managed equity funds _.<br>A) outperform

Q71: The average returns, standard deviations and betas

Q72: The critical variable in the determination of

Q73: A portfolio generates an annual return of