Multiple Choice

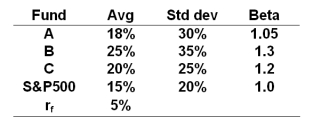

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-Which one of the following is largely based on forecasts of macroeconomic factors?

A) Security selection

B) Passive investing

C) Market efficiency

D) Market timing

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Active portfolio managers try to construct a

Q69: Most professionally managed equity funds _.<br>A) outperform

Q71: The average returns, standard deviations and betas

Q72: The critical variable in the determination of

Q73: A portfolio generates an annual return of

Q75: In the Treynor-Black model,the active portfolio will

Q76: Assume you purchased a rental property for

Q77: A portfolio generates an annual return of

Q78: A managed portfolio has a standard deviation

Q79: One hundred fund managers enter a contest