Multiple Choice

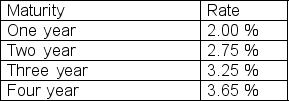

Find the one-year forward rate for year three given the following zero coupon rates:

A) 3.51%

B) 4.26%

C) 4.86%

D) 4.56%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: A "fixed for floating" interest rate swap

Q11: Characteristics of futures contracts include<br>I.traded on an

Q21: Assume company L wants to pay a

Q38: By definition LIBOR is:<br>A)the long-term inter-bank option

Q41: Given: the future spot rate C$0.00965 per

Q42: Which of the following refers to the

Q44: Assume the spot exchange rate today is

Q44: What are the differences between forwards and

Q48: In order to estimate the forward rate

Q51: The six-month forward rate is C$ 1.00