Multiple Choice

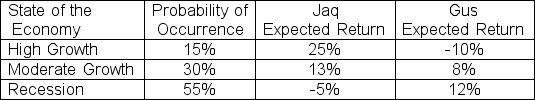

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts,what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

A) Portfolio weights in Jaq and Gus are 74.37% and 25.63%, respectively

B) Portfolio weights in Jaq and Gus are 25.63% and 74.37%, respectively

C) Portfolio weights in Jaq and Gus are 60.51% and 39.49%, respectively

D) Portfolio weights in Jaq and Gus are 39.49% and 60.51% respectively

Correct Answer:

Verified

Correct Answer:

Verified

Q30: What are the components of total return

Q47: Which of the following statements is FALSE?<br>A)All

Q51: Stocks A and B have a correlation

Q52: Suppose you own a portfolio that has

Q54: A portfolio consists of two securities: Nervy

Q55: If the closing price of Stock Y

Q57: A stock selling for $20.00 today and

Q59: Suppose you own 100 shares of CyberChase

Q85: Which of the following is a FALSE

Q89: If a company's stock price decreases due