Multiple Choice

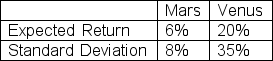

Suppose you observed the following data on two securities: Mars and Venus:

You short sold 200 shares of Mars at $20 per share and purchased 400 shares of Venus at $25 per share to increase the possible return on the portfolio.The correlation between the securities is 0.30.What is the standard deviation of the portfolio?

A) 7.06%

B) 26.56%

C) 32.45%

D) 56.96%

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Calculate the correlation between the two stocks.<br>A)

Q39: The expected return on Alpha Inc.is 8

Q42: Connie bought 400 shares of ABC Company

Q42: Which of the following statements is TRUE?<br>A)The

Q45: Discuss the validity of the following statement:

Q46: What is the standard deviation of returns

Q47: The expected returns for Bumpy Inc.and Bouncy

Q48: Which of the following statements is FALSE?<br>A)

Q56: Christopher Robin purchased 500 shares of Pooh

Q109: Define and discuss expected return with regard