Essay

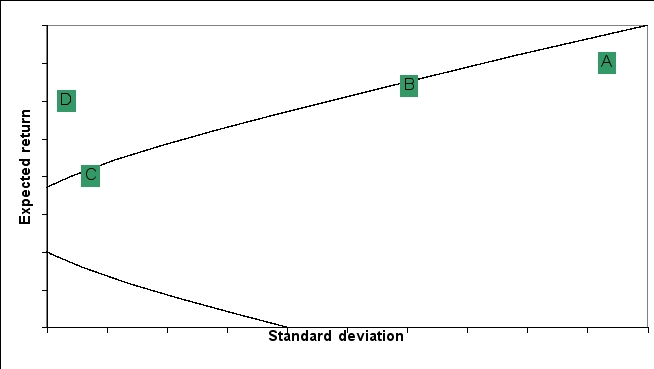

The standard deviation and expected returns for 4 portfolios (A,B,C,and D)are graphed on the following efficient frontier:

Which of the following portfolios (or combinations)are likely to be preferred by a risk-averse investor? Which of the following portfolios (or combinations)are likely to be preferred by a risk-loving investor? Explain your reasoning.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Given the information in the following table,what

Q5: The income yield and capital gain yield

Q6: Indiana Jones intends to form a portfolio

Q7: Given the following forecasts,what is the expected

Q8: In a two-security portfolio 25% of your

Q9: In question 18 above,what is the income

Q10: The standard deviation and expected returns for

Q11: A stock selling for $12.00 today and

Q37: Which of the following statements is FALSE?<br>A)Risk

Q90: Does diversification always reduce the overall risk?