Multiple Choice

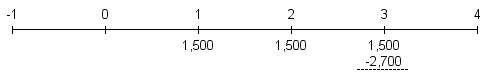

Felix has been offered a three-year ordinary annuity with annual payments of $1,500.The price of the annuity is $2,700.Which of the following is the most appropriate timeline for this investment?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q25: As interest rates rise, future values<br>A)increase.<br>B)decrease.<br>C)stay the

Q29: How much should a monthly compounded account

Q38: The interest earned on both the original

Q51: Amir has obtained a $250,000 mortgage.The mortgage

Q58: On January 1,2016 your bank approved your

Q59: Elvira is considering buying a 20-year ordinary

Q64: Consider two investments: XPD and PDQ.Each investment

Q66: You won the lottery and you were

Q67: Your investment account pays interest at a

Q78: An annuity due pays out<br>A)equal payments at