Multiple Choice

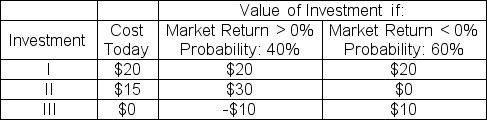

Which of the following investments would a risk-averse investor prefer if the risk-free rate is zero?

A) I only

B) II only

C) III only

D) I and III only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: What is the expected return for a

Q7: Use the following three statements to answer

Q8: Stock A has a standard deviation of

Q10: The expected return of Security A is

Q11: In the above question,F<sub>1</sub> F<sub>2</sub><sub>,</sub> and F<sub>3</sub>

Q12: The expected return of Security A is

Q21: What is the role of the risk-free

Q28: The beta of a portfolio can be

Q77: Which of the following is a FALSE

Q90: Assuming the CAPM is valid, _ securities