Multiple Choice

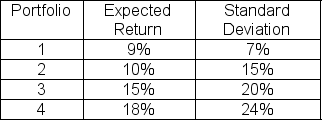

The expected return on the market is 11.5 percent with a standard deviation of 13 percent and the risk-free rate is 4 percent.Which of the following portfolios are undervalued?

A) 1 and 2 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Which of the following is NOT a

Q94: The expected return on the market is

Q95: What is the expected payoff from an

Q97: Which one of the following stocks does

Q98: The expected return on the market is

Q100: The CAPM Model makes all the assumptions

Q101: A risk-averse investor has an opportunity to

Q102: Stock Y has a standard deviation of

Q103: Suppose you have $5,000 to invest in

Q104: Which one of the following is NOT