Multiple Choice

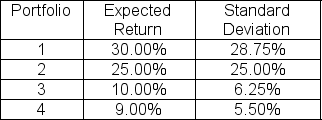

The expected return on the market is 15 percent with a standard deviation of 12.5 percent and the risk-free rate is 5 percent.Which of the following portfolios are correctly priced?

A) 1 and 3 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: Use the following three statements to answer

Q16: The risk-free rate is 5.25 percent.The expected

Q17: What is the beta of a portfolio

Q18: What is the expected return on an

Q20: The market expected return is 14 percent

Q21: Security A is estimated to be linearly

Q22: Explain the separation theorem.

Q23: The expected returns for Securities ABC and

Q77: Which of the following is a FALSE

Q92: By combining the risk-free asset and the