Multiple Choice

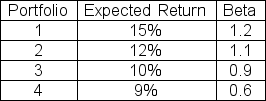

The expected return on the market is 12 percent with a standard deviation of 16 percent and the risk-free rate is 4.5 percent.Which of the following portfolios are overpriced?

A) 1 and 3 only

B) 1 and 4 only

C) 2 and 3 only

D) 2 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q41: Beta is a measure of:<br>A)Total risk.<br>B)Diversifiable risk.<br>C)Systematic

Q44: Suppose the beta of a four-asset portfolio

Q45: Which of the following is a NOT

Q47: Suppose you have $4,000 to invest in

Q48: Is it possible to invest more than

Q50: A portfolio has $1,200 invested in a

Q51: Given the following information,what is the beta

Q52: What is the standard deviation for a

Q53: Stock XYZ has a beta of 1.6

Q54: The market portfolio is most accurately described