Essay

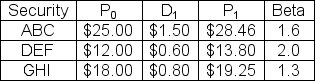

The risk-free rate is 4 percent.The expected return on the market portfolio is 12 percent with a standard deviation of 16 percent.Which security is over,under,or correctly priced?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q31: Use the following three statements to answer

Q35: Marie has $10,000 to invest.She decided to

Q36: An efficient portfolio has a 18% expected

Q37: What is the beta of a portfolio

Q39: Stock X has a standard deviation of

Q41: Suppose you have $2,000 to invest.The market

Q42: Which of the following is NOT a

Q43: The expected return on the market is

Q44: Suppose the beta of a four-asset portfolio

Q45: Which of the following is a NOT