Essay

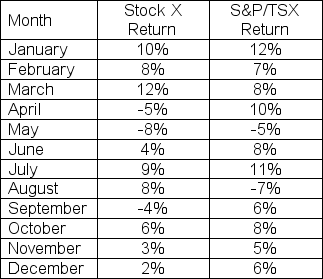

Given the following information:

a) What are the average monthly returns on Stock X and the S&P TSX?

b) What are the standard deviations of the monthly returns on Stock X and the S&P TSX?

c) What is the covariance of the returns on Stock X and the S&P TSX?

d) What is the beta of Stock X?

e) What is the implied risk-free rate?

Correct Answer:

Verified

a)Stock X average monthly return  S&P/TS...

S&P/TS...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: What does the capital market line represent?<br>A)The

Q65: What is the standard deviation of an

Q66: The CML relates:<br>A) expected return to beta.<br>B)

Q68: A portfolio consists of two securities: a

Q69: The current price of Stock Y is

Q71: The market expected return is 14 percent

Q72: Greg has $10,000 to invest in a

Q74: Which of the following describes how the

Q75: Assume that the CAPM holds.If a security

Q81: Under the CAPM, an investor should be