Multiple Choice

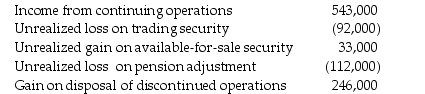

Gerogi Company had the following balances for income from continuing operations and pretax gains and losses on December 31:  The company's effective tax rate is 40%.What amount should Gerogi Company report as comprehensive income for the year ended December 31?

The company's effective tax rate is 40%.What amount should Gerogi Company report as comprehensive income for the year ended December 31?

A) $426,000

B) $495,600

C) $606,400

D) $643,200

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Why are results from discontinued operations separated

Q45: What items are included in a company's

Q46: Paxdot Labs provided the following partial-trial balance

Q50: What is the most common approach to

Q51: Gerogi Company had the following balances for

Q52: Which of the following is false concerning

Q53: Clowns-R-Us reported the following in the statement

Q74: Which of the following items does IFRS

Q106: Identify and describe the two primary factors

Q116: Other comprehensive income is comprised of elements