Essay

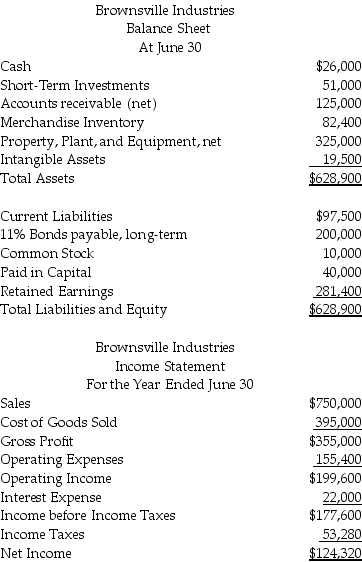

Presented below are financial statements for Brownsville Industries:

Compute the following ratios

Compute the following ratios

a.Current ratio

b.Debt to Equity Ratio

c.Interest Coverage Ratio.

d.Return on Assets

e.Financial Leverage.

f.Return on Equity

What do these ratios reveal about the financial condition of Brownsville Industries?

Correct Answer:

Verified

Without prior year comparisons,it is di...

Without prior year comparisons,it is di...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Which of the following is considered an

Q38: If an auditor is unable to form

Q55: The current ratio is for Matthews Corporation

Q57: The financial leverage for Matthews Corporation is

Q58: Which of the following is a component

Q62: Cash flows from financing activities are _.<br>A)$(1,100)<br>B)$1,220<br>C)$1,400<br>D)$2,200<br>

Q65: Danielsen,Inc had salaries payable of $50,000 as

Q109: A firm that responds quickly to unexpected

Q137: The report format of the balance sheet

Q138: Disclosure of a related-party transaction must include