Multiple Choice

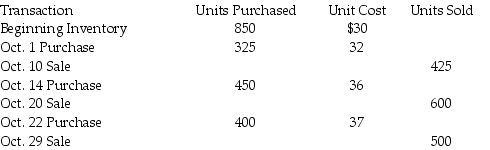

Jones Company has the following data available:  If Jones Company uses a perpetual LIFO inventory system,the cost of ending inventory on October 31 is ________.

If Jones Company uses a perpetual LIFO inventory system,the cost of ending inventory on October 31 is ________.

A) $14,800

B) $18,500

C) $15,000

D) $66,900

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Flynn Company uses LIFO for tax purposes

Q74: Inventory costs do not include _.<br>A) freight-out

Q99: Freight-in costs are treated as a selling

Q105: The LIFO effect is _.<br>A) the change

Q120: Basking Company adopted the dollar-value LIFO method

Q122: The Geewhiz Company uses the perpetual inventory

Q124: On June 1,Kennedy Company purchased $5,000 of

Q127: The following information is available for the

Q128: Cohen Company follows U.S.GAAP and uses the

Q130: A company uses the basic retail method