Essay

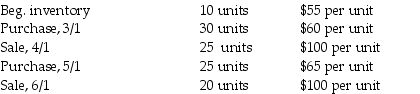

Carbondale Company had the following data available for the last six months:

Operating expenses are $2,000 per month.The income tax rate is 30%.

Operating expenses are $2,000 per month.The income tax rate is 30%.

Required:

1.Compute Cost of Goods Sold for the six months ending June 30 using:

a.FIFO perpetual

b.LIFO perpetual

2.How much will the company save in income taxes if they use LIFO instead of FIFO?

Correct Answer:

Verified

1.a.FIFO Cost of Goods Sold:  ...

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: The inventory turnover ratio equals _.<br>A) cost

Q59: When following U.S. GAAP, which of the

Q61: At the end of the year,Katerinos Company

Q62: Following U.S. GAAP, required inventory disclosures in

Q62: The Wysocki Company has undertaken a physical

Q64: Jesse Company has the following data for

Q66: Which inventory costing method most closely approximates

Q67: A department store wants to estimate the

Q69: Smith-Miller Enterprises has inventory of $657,000 in

Q88: A perpetual inventory system always provides current